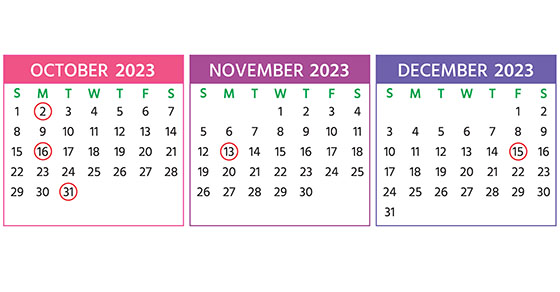

2023 Q4 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note: […]

It’s important to understand how taxes factor into M&A transactions

In recent years, merger and acquisition activity has been strong in many industries. If your business is considering merging with or acquiring another business, it’s important to understand how the transaction will be taxed under current law. Stocks vs. assets From a tax standpoint, a transaction can basically be structured in two ways: 1. Stock […]

Update on depreciating business assets

The Tax Cuts and Jobs Act liberalized the rules for depreciating business assets. However, the amounts change every year due to inflation adjustments. And due to high inflation, the adjustments for 2023 were big. Here are the numbers that small business owners need to know. Section 179 deductions For qualifying assets placed in service in […]

Plan now for year-end gifts with the gift tax annual exclusion

Now that Labor Day has passed, the holidays are just around the corner. Many people may want to make gifts of cash or stock to their loved ones. By properly using the annual exclusion, gifts to family members and loved ones can reduce the size of your taxable estate, within generous limits, without triggering any […]